Table of Contents

- Walmart rewrites the rulebook: Equity, expansion, and evolution ...

- The top Walmart analyst says the company has one big advantage over ...

- 3 Reasons to Consider Buying Walmart Stock Right Now | InvestorPlace

- Is Walmart Stock A Buy Or Sell After Recent Earnings? (NYSE:WMT ...

- WALMART (WMT) STOCK ANALYSIS - YouTube

- WALMART Stock Price Prediction News Today 4 October - WMT Stock - YouTube

- Why Wal-Mart Stock Has Surged 20% in 2016 - Nasdaq.com

- Walmart stock earnings send WMT to all-time high

- Walmart (WMT) Stock Rises on New Partnership With UnitedHealth ...

- Could Walmart Be the Ultimate Growth Stock? | Entrepreneur

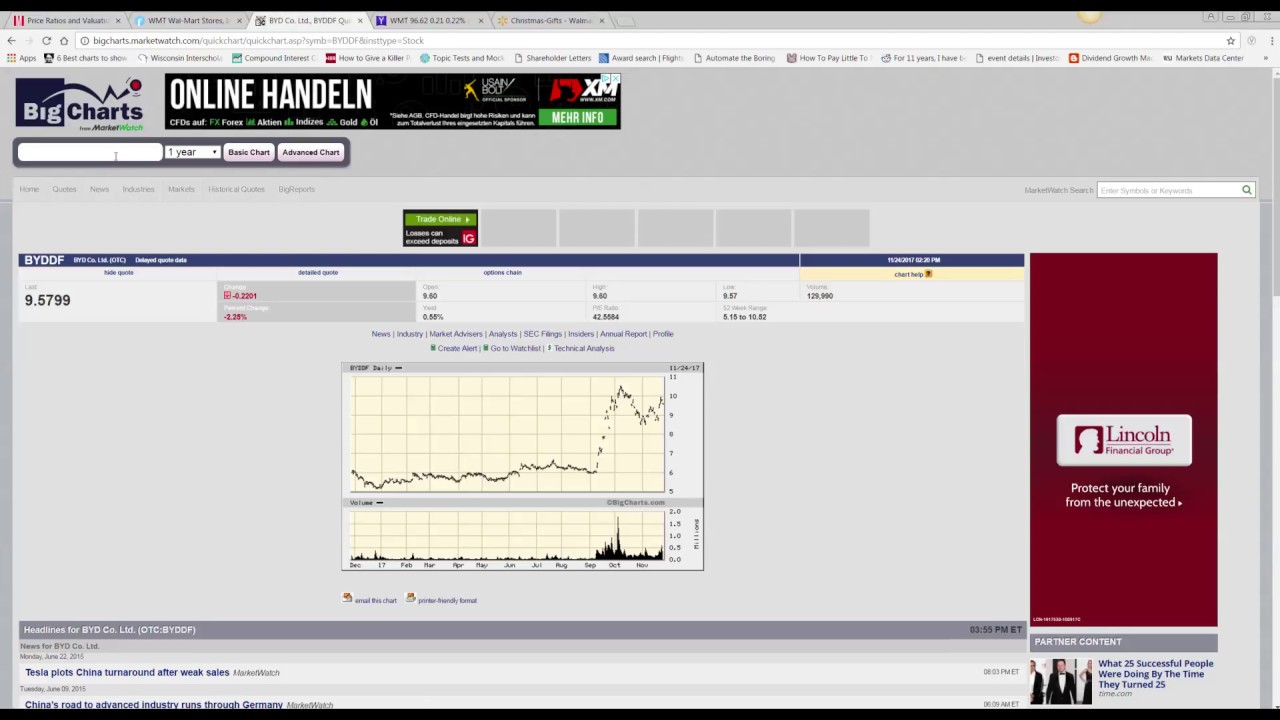

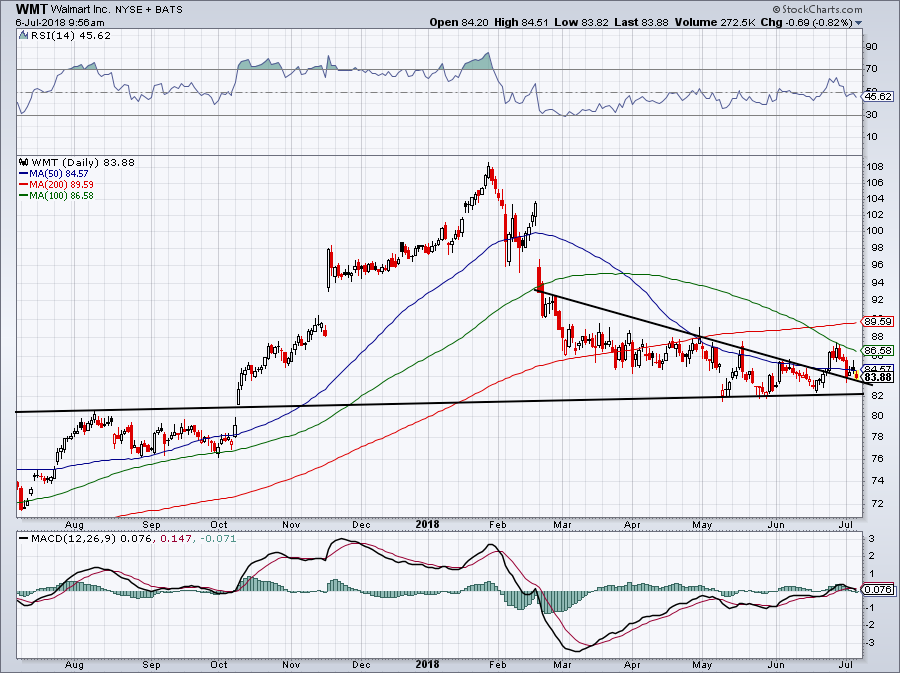

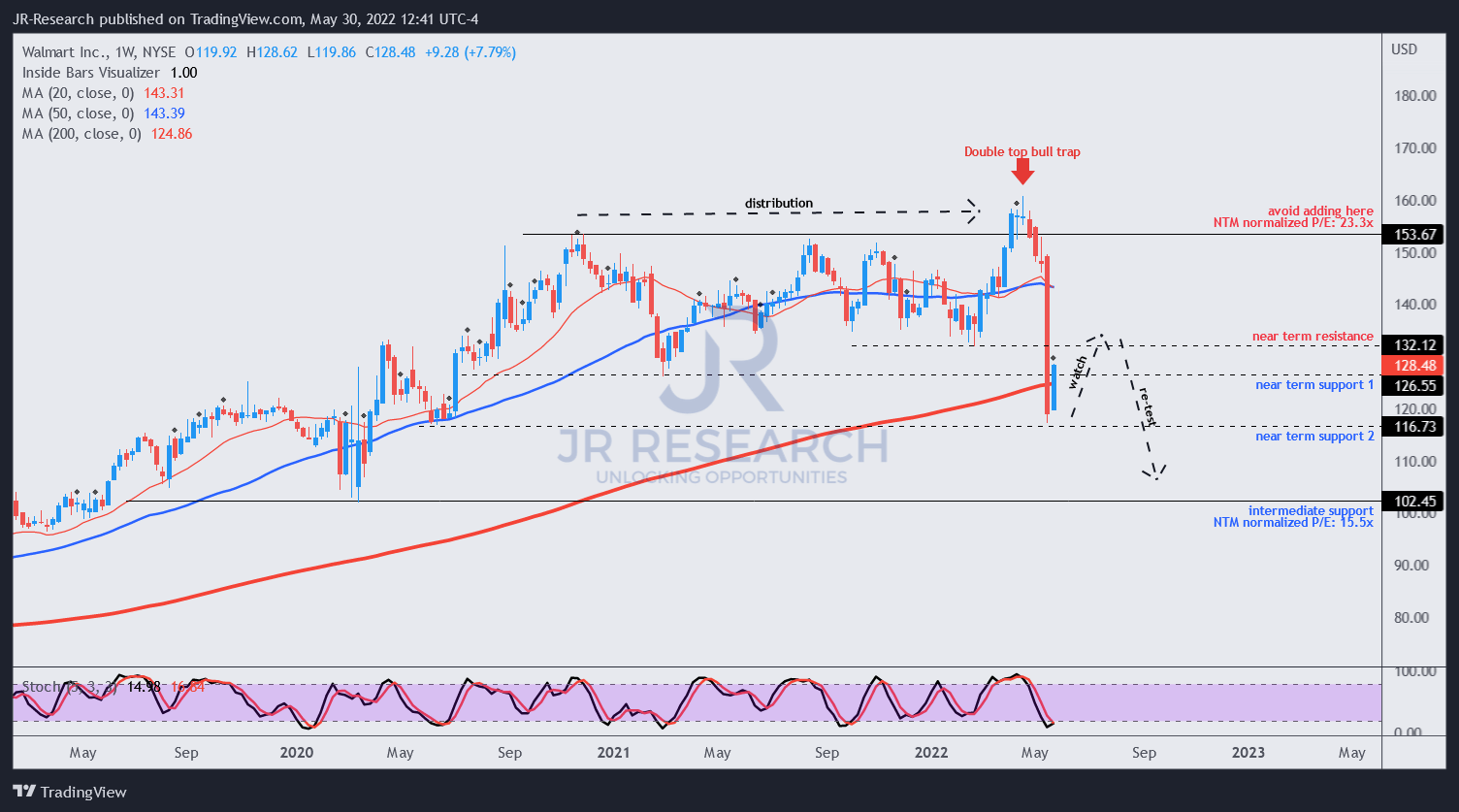

Current Stock Price and Performance

Latest News and Developments

Financial Performance and Outlook

WMT's financial performance has been strong in recent quarters, with the company reporting increased revenue and profit growth. In its latest earnings report, WMT posted a net income of $3.9 billion, up 12% from the same period last year. The company's e-commerce sales grew 37% year-over-year, driven by increased online shopping demand and investments in digital capabilities. Looking ahead, WMT expects to continue investing in e-commerce, digital transformation, and store remodels to drive growth and improve customer experience. The company has also announced plans to increase its minimum wage for hourly workers, aiming to attract and retain top talent in a competitive labor market.

Analyst Ratings and Recommendations

According to Reuters, WMT has a consensus rating of "Buy" among analysts, with a price target of around $150 per share. Many analysts believe that WMT's investments in e-commerce and digital transformation will drive long-term growth and increase its competitiveness in the retail market. However, some analysts have expressed concerns about the company's valuation, citing the potential for increased competition from online retailers such as Amazon. Additionally, WMT's grocery business faces intense competition from other retailers, which could impact its profitability. In conclusion, WMT's stock price and latest news reflect the company's ongoing efforts to transform its business and drive growth in a rapidly changing retail landscape. With its strong financial performance, strategic investments, and commitment to customer experience, WMT is well-positioned for long-term success. However, investors should remain aware of potential risks and challenges, including increased competition and market volatility. As always, it's essential to conduct thorough research and consult with financial experts before making any investment decisions.Stay up-to-date with the latest news and updates on WMT's stock price and performance with Reuters.